About Fixed & Variable Home Loan

Fixed rates mean that the interest you pay stays the same for the duration of the fixed loan period, which is usually between 1 and 5 years and common one is 2 years. So, whether the Reserve Bank of Australia (RBA) and your lender are cutting interest rates or whether they’re increasing the interest rate, you’re not impacted. It’s a bit of a double-edged knife – you’re safe from unpredictable market fluctuations, but you’re also unable to benefit from decreased rates, that means if fixed interest rate goes below than existing one then also you will be paying same.

With variable rates, you’re at the mercy of the RBA and your lender of choice. So, while interest rates are quite low at the moment (We are at the historically low interest rate) if the rate increases, your home loan interest rate will increase as well. Again, you encounter that darn double-edged knife.

Yes, fixed and variable rates have their positive and negative side, so let’s look at them a little closer to see which positive and negative will impact on your situation the most.

Good to know about Fixed- Rate Home Loan

If you’re a stickler for budgeting, fixed-rate home loans make budgeting much easier. For the term of your loan, you know what your repayments will be. The rates have been increased? You’re not impacted. This predictability has more benefits than pure peace of mind – it can also help you budget into the future, which is greatly beneficial to those on a tight budget because they’re able to predict their output.

Another thing to consider is that if you suddenly come into a wad of money, your options for additional payments may be limited, or not allowed at all. You’re pretty much locked in. You can also be penalised for paying more than the approved extra repayment limits and relatively hefty exit fees can apply if you ditch your loan before the end of the term (let’s say 2 years of fixed loan term).

Good to know about Variable- Rate Home Loan

Variable rates generally have more features than fixed rates, including redraw/ off set account facilities, the option to make extra repayments and more flexible loan features – you’re not as ‘locked-in’ as you are with a fixed rate.

Having said that, it can be difficult to see which way the market will turn, so you need to be prepared for the ups and down of the market and be aware that your budget will be affected by increased rate changes. You will not be able to be as rigid as you would with a fixed rate.

When selecting which home loan type is best for you, you really need to look at the current state of your finances as well as your vision for the future: how much security do you need? How much flexibility does, and will your lifestyle afford you? Are you going to hold on to your home in the long term? It’s not just what offers the best deal – it’s what suits your lifestyle and goals the most. Know your cash flow moment.

That is why, we usually recommend splitting the loan amount to Fixed and Variable. When we sit down and know your situation we suggest accordingly but you’re the one to make ultimate decision. I’ll give 2 examples to elaborate more in details, lets say clients are looking for $500k property with $420k Loan amount.

Example 1: One couple with not much other liabilities (like credit card, personal loan, car loan with higher interest rate than home loans).

Answer: we usually give an option to split loan like $320k as 2 years fixed and $100k as a variable. Here, in $100k you can contribute extra repayment and sometimes it comes with offset account features too.

Example 2: One couple with other liabilities (like credit card, personal loan, car loan with higher interest rate than home loans).

Answer: If you have to pay other liabilities with higher interest rate PLUS your existing home loan repayment. In this situation you can discuss with us and fixed the loan for some time and pay off all other liabilities.

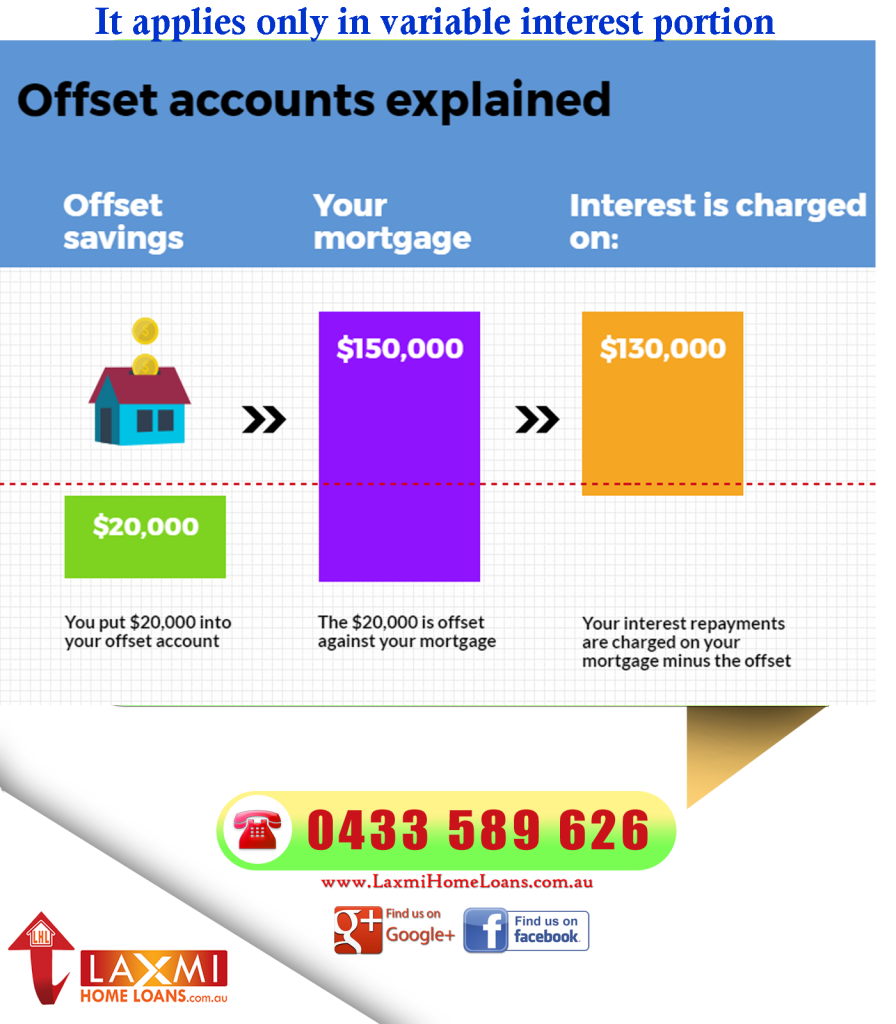

What is offset account?

We can say offset account as an interest saving account. When we put extra money in our offset account, we don’t have to pay interest on that balance, this will reduce the mortgage interest charged accordingly. So, you might have a $200,000 loan and $25,000 in your offset account. Because of your offset account, you will only be charged interest against $175,000. If we manage to have a decent amount of money in your offset account, we can effectively cut years and thousands of dollars from your home loan.

Disclaimer: Every individual has different circumcenters so please take above information as a general information only. Seek professional advice before making any financial decision.

Posted on: May 5, 2019, By: Laxmi - LHL